Talkmore Gandiwa

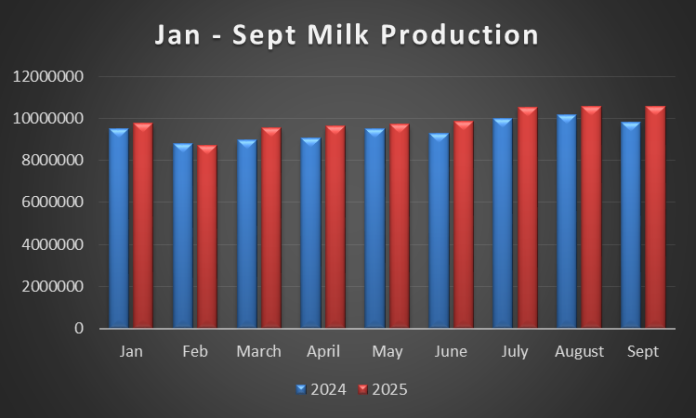

HARARE (FinX) – Zimbabwe’s milk production continues on an upward trajectory, with September 2025 output rising 7.85% to 10.57 million litres, up from 9.80 million litres recorded during the same period last year — the highest monthly output this year.

The growth is largely driven by the increased investment by the new player into the dairy industry and the cost cutting measures introduced by the government to drive growth in the dairy sector. For the first nine month to September 2025 was recorded at 88.9 million litres as compared to 85 million litres recorded in the prior year.

According to the latest figures from the Dairy Services Department, milk intake by processors jumped 8.61% to 9.82 million litres, compared to 9.05 million litres in September 2024. However, milk retailed directly by producers slightly dipped by 1.14%, from 756,025 litres last year to 747,410 litres this year, highlighting ongoing structural shifts in the distribution chain as more milk moves through formal processing channels.

The growth recorded in September extends a consistent upward trend observed throughout 2025. From January to September, total milk production has shown resilience, registering positive growth in most months despite cost pressures, input shortages, and climatic uncertainties.

A deeper look at the data reveals a strong shift towards processor-handled milk, which has grown steadily throughout the year. Milk intake by processors in 2025 has consistently outpaced 2024 figures, reflecting stronger confidence in formal processing and marketing systems.

For instance, processor intake grew by 7.63% in March, 7.33% in April, and 7.12% in June, as dairy processors expanded capacity and improved collection logistics. On the other hand, milk retailed by producers — typically small-scale farmers selling directly to consumers — has shown marginal declines in most months, dropping between 1% and 4%.

This trend underscores the ongoing formalisation of the dairy sector, as government policies and private investments push for more milk to be channelled through registered processors to ensure quality control, product diversification, and value addition.

Industry attributes the sustained growth to a combination of improved feed availability, enhanced breeding programmes, and growing private sector investment in cold-chain infrastructure.

Dairy processors have partnered with farmers under the Zimbabwe Association of Dairy Farmers (ZADF) to strengthen milk collection systems, provide technical training, and expand access to artificial insemination services aimed at improving herd genetics and productivity.

Furthermore, ongoing feedstock interventions, supported by government and development partners, have improved the supply of affordable stockfeed — a key cost driver in dairy production.

Zimbabwe’s dairy industry is targeting 130 million litres in total production by the end of December 2025, up from an estimated 105 million litres in 2024. With consistent month-on-month growth and stronger performance in the second half of the year, the target now appears within reach.

If the current trajectory is maintained, the sector could surpass the 130 million-litre milestone, marking a major recovery from the Covid-19 pandemic period when milk output dropped below 80 million litres.

The growth trajectory aligns with the government’s Livestock Growth Plan (2021–2025), which seeks to achieve milk self-sufficiency, reduce imports of dairy products, and boost value addition. The plan envisions a vibrant, export-oriented dairy industry that contributes meaningfully to national food security and employment.

Private sector players such as Dendairy, Probrands, and Dairibord Holdings Limited have been key growth drivers, investing in processing technology, smallholder support schemes, and rural milk collection centres. These initiatives are bridging the gap between smallholder producers and formal markets, improving milk quality and reducing post-harvest losses.

Government support through incentives, duty exemptions on dairy equipment, and access to affordable finance under the Agricultural Finance Corporation (AFC) has further boosted the sector’s competitiveness.

While the sector faces challenges such as high input costs, power shortages, and inconsistent rainfall patterns, the resilience shown in 2025 reflects growing maturity in the dairy value chain. The steady performance, particularly in the third quarter, signals a recovering and stabilising sector poised to meet both domestic demand and future export potential.

If momentum continues through the fourth quarter, Zimbabwe’s dairy industry will not only meet its 130 million-litre target but also reinforce its position as one of the fastest-growing agricultural subsectors under the National Development Strategy 1 (NDS1) framework.