FinX

HARARE – (FinX) Zimbabwe’s economy will register a negative growth 2.5% in 2020 from a negative 5.5% growth in 2019 owing to foreign currency shortages, elevated public debt and uncontrolled inflation, a recent report shows. It is, however, poised to grow by 3% in 2021.

This year’s projection is against the 2.7% and 3% forecast by the World Bank (WB) and the Treasury.

Southern Africa’s economy deteriorated in 2019, with several economies stagnant or in recession amid weak investment, energy shortages, high unemployment and catastrophic weather. After an estimated expansion of only 0.3% in 2019, GDP growth is projected at 0.9% in 2020 before gradually recovering to 1.9% in 2021. In per capita terms, economic activity in the sub region will continue to contract until at least 2021.

The number of people living in extreme poverty (those subsisting on less than $1.90 per day) continue to rise in sub-Saharan Africa and currently account for more than half of the extreme poor globally.

In its latest report, World Economic Situation and Prospects 2020, United Nations (UN) said the country is experiencing a severe crisis.

“In Zimbabwe, economic and financial conditions have deteriorated substantially, prompting the return of hyperinflation,” UN stated.

The short-term risks across African sub regions are tilted to the downside. On the domestic front, agricultural output is highly exposed to weather-related shocks, with potential for dire economic and social consequences. Political conflicts, social instability and security concerns, UN said, are major downside risks across the continent which can affect the short-term outlook in many countries in the region.

“There is also an elevated risk that difficult economic conditions in some countries in southern Africa could become more entrenched, leading to more prolonged recessions in Angola, Namibia and Zimbabwe. The upsurge in external sovereign bond issuances has also raised debt sustainability concerns in some countries, which could be exacerbated by external or domestic shocks, including slippages in fiscal management.”

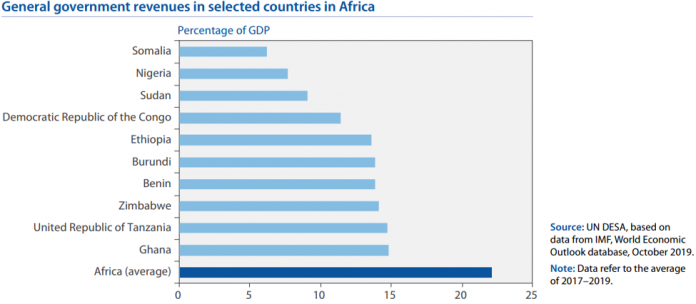

Fiscal consolidation continues in most parts of Africa. In 2019, the aggregate fiscal deficit is estimated to have declined moderately due to expenditure cuts, especially in oil-importing countries. But, fiscal deficits among oil exporters widened as a result of the slower-than-expected increase in oil prices.

“Meanwhile, in southern Africa fiscal deficits are deteriorating as a result of difficult economic conditions in Angola, South Africa and Zimbabwe and lower-than-expected oil prices in Angola,” it said.

UN noted that elevated public debt is a challenge in several African countries, limiting the capacity to implement counter-cyclical and socially inclusive policies. Public debt levels exceeded 100% of GDP in countries such as Cape Verde, the Congo, Djibouti, Eritrea, Mozambique and Sudan.

“Some economies with lower debt ratios, including Zimbabwe, face increasing repayment burdens.”

Over the past decade, the rise in public debt has been driven by expansionary fiscal policies and knock-on effects from the commodity price shock of 2014/15, while search-for-yield behavior among investors has encouraged external borrowing. The expansion of debt is gradually moderating as a result of fiscal consolidation efforts; however, there are large variations among countries.