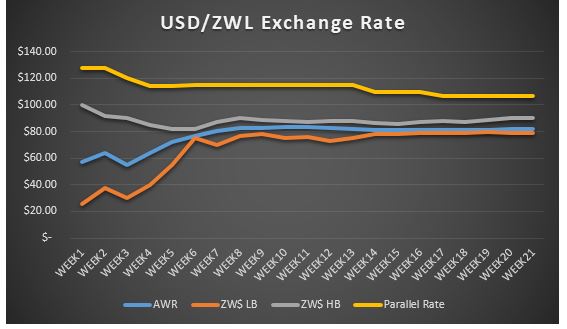

HARARE – The local currency maintained a crawling pattern on Tuesday, depreciating a marginal 0.044% to 81.7102 against the US dollar from 81.6741 attained last week. This comes as focus of the Reserve Bank of Zimbabwe now turns its attention towards building international reserves.

According to the National Development Strategy (I), the central bank will improve and enhance the efficiency of the foreign exchange auction system, introduced in June 2020, building on its evident positive results. But to ensure sustainability of the system, and further buttress exchange rate management, RBZ will prioritise building of international reserves.

The highest allotted rate was at 90 from last week’s 86.30 and the lowest rate for the main auction was at 80 widening the spread between bids to 13.92% from 13.78% last week.

A total of US$29.74mln was apportioned to both the Main Auction (US$27.44m) and SMEs (US$2.3m – its highest to date) at the recent auction after a combined 431 bids were accepted and 55 were rejected. Raw materials continued to receive the highest allocation at US$11.6 mln, Machinery and Equipment US$6.18 mln, Consumables US$2.58 mln, Retail and Distribution US$2.27 mln, and Services at US$2.9 mln. Other amounts below US$2 mln were allotted to Pharmaceuticals and Chemicals, Paper and Packaging and Fuel, Electricity and Gas.

The difference in the average weighted rate and the highest bid narrowed this week as it came in at 9.21% from 9.25% of the previous auction. The difference between the parallel market rate and the weighted average rate shrunk to 23.64 after widening to 23.67 last week.

No changes were recorded on the parallel market while there was movement on the Zambian HBEI to 21 which is within range of the official exchange rate of 20.97

Cryptocurrencies are riding on a number of negative events happening in the west and in Europe. With the Americas fighting a hurricane on top of the refusal to concede defeat by President Trump and the resurgence of lockdowns in Europe, Bitcoin surged 1.64% ($286.35) to $17 032.00. Ethereum and Bitcoin Cash also saw a day of heavy gains on the market with the former adding 1.02% ($5.52) to $469.97 whilst the latter closed 0.38% ($0.61) stronger at $252.90.

| Street Rates | Bond | Mobile Money | ||||

| US$ | Buying | Selling | Daily Change | Buying | Selling | Daily Change |

| Eastgate | 75 | 85 | 0% | 87 | 98 | 0% |

| Copa Cabana | 76 | 85 | 0% | 87 | 98 | 0% |

| Market Square | 76 | 85 | 0% | 87 | 98 | 0% |

| Rand ZAR | Buying | Selling | Daily Change | Buying | Selling | Daily Change |

| Market Square | 15 | 16.50 | 0% | – | – | 0% |

| Eastgate | 15 | 16.50 | 0% | – | – | 0% |

| Roadport | 15 | 16.50 | 0% | – | – | 0% |

| Malawi HBEI | 700 | ||||

| Mozambique HBEI | 70 | ||||

| Zambia | 21 | ||||

| DRC | 2100 | ||||

| HBEI Zim | 105 | ||||

| OMIR | – | ||||

| October | September | ||||

| CPI | 2,301.67 | 2,205.24 | |||

| Monthly Inflation | 4.37% | 3.83% | |||

| Annual Inflation | 471.25% | 659.40% | |||

| Crypto-Currencies (US$) | |||||

| Bitcoin | $17,032.00 | ||||

| Ethereum | $469.97 | ||||

| Bitcoin Cash | $252.90 |