Tapiwanashe Mangwiro

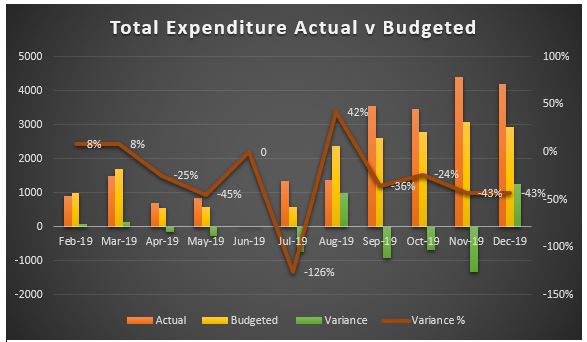

HARARE – Government’s expenditure for 12 months ending 31 December 2019 exceeded actual budget of Z$4.93b by 28.01% against Treasury’s Transitional Stabilization Programme objectives. Expenditure shot to Z$22.53 billion although the government’s economic blueprint sought to reduce spending to make room for developmental projects and programs that support production.

The two-year plan ending this fiscal year, included reform initiatives to revive slow economic growth, restore order to the public finances after years of fiscal slippage and address chronic external imbalances that have left Zimbabwe with acute forex shortages.

Overall the country had total revenue of Z$22.97bn against budgeted income of Z$19.2bn due to inflationary pressures. Tax revenue exceeded budgeted amount of Z$18.6bn by 20.975 to Z$22.5bn, which represented 97.95% of total revenue. Non tax revenue missed budgeted figures by 35. 888كازينو 48% as it came in at Z$0.4bn against a budget of Z$0.62bn.

For the year 2019 Treasury therefore closed the year with an actual surplus of Z$440 million despite not fulfilling some obligations such as CAPEX and debt repayment as per their budget.

Depreciation in value of the local currency against the US dollar and huge foreign travel delegations in the 12 months period saw the latter surpassing the budgeted Z$183 million by three-fold to a whooping Z$578 million.

In the same vein, employment costs exceeded actual budget of Z$4.7 billion by 29.36% to Z$6.08 billion due to the awarding of cost of living adjustment (COLA) by the government to its workers. العاب شيش However, on capital expenditure, government lived within its means and used less money at Z$1.4 billion against a budget of Z$1.8 billion.

Capital expenditure was, 33.10% above budget as Z$9.37billion was used against a budgeted Z$7.04 billion. However most 75% of that money were capital transfers to the Ministry of Transport for ZUPCO activities, Ministry of Agriculture and Local Authorities for Command Agriculture repayments.

Actual capital developments spent 10% less than budgeted Z$2 billion which is surprising as Zimbabwe is still recovering from the shocks of Cyclone IDAI which ravaged infrastructure in the eastern parts of the country.

Foreign debt budget stood at Z$121 million although the government only paid Z$88 million, probably as a result of the depreciation of value in local currency and in December no foreign debt obligations were paid.

On domestic debt the government paid interest to the tune of Z$289 million against a budget of Z$365 million.

For the year, it was at the beginning of April when costs began to rise as inflation came into play and the introduction of the said employee salary cushions which were not budgeted for. سيرجو راموس As the year went on Treasury began to experience and increase in costs as prices rose monthly, which might explain why they went against capital expenditure in a hyper-inflationary environment.

Treasury needs to find ways to stimulate growth in order to reduce deficit. As the economy grows the country will increase tax revenue through a broader tax base without necessarily increasing taxes.

Economic growth is the least painful way to reduce deficit as it does not cut government spending or raise taxes. Another way to reduce budget deficit the authorities need to cut back the rate of growth of money supply as it is fuelling inflation which affected the TSP goals of spending cuts, due to COLA.

In order to manage shocks in the economy, Zimbabwe needs to strengthen its emergency reaction fund and create it if it does not exist as it reduces the impact of shocks on the budget.