HARARE – Ariston says volumes of the group’s major crops are expected to be in line with prior year, however tea will be 5% lower due to the dry spell experienced in the first quarter.

In its trading update for the first quarter to December, the agro-producer said that indicative prices which were obtaining in early season sales, show that the average

selling prices on the international markets will be in line with prior year. However the largest constraint remaining is the incessant power outages which have negatively affect the ability to irrigate orchards thus affecting tea leaf availability and quality.

To get round the challenge, the group is currently evaluating installation of a solar power generation plant at the largest of its tea growing Estates in order to counter the negative effects of power outages.

The other challenge remains the occurrences of disturbances on farms, which continue to hamper progress. Engagements with the relevant authorities continue with the aim of finding a lasting solution that would protect the group’s assets.

In terms of operations for the quarter, little is expected as the period coincides with the growing phase of the group’s crops. The group continues to grow its export market so as to cushion from the local trading environment, which has been characterised by declining demand and uptake of products.

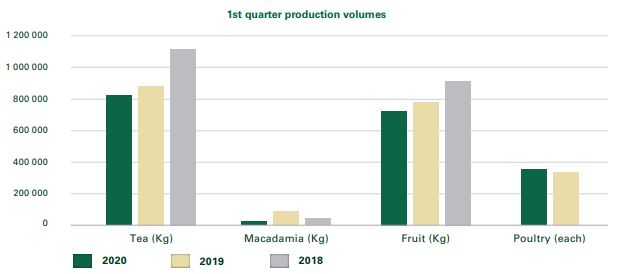

As shown in the table above, tea production volumes for the first quarter are slightly behind prior years as a result of the dry spell experienced in the current year which

was compounded by intermittent availability of electricity for irrigation.

Macadamia harvesting season commences in March and low volumes in the first quarter is indicative of greater macadamia nuts available at maturity. According to the group, mature nuts obtain better selling prices.

The fruit category volumes have increased significantly this year. However, harvesting of the fruit in the first quarter was deliberately delayed so as to have less product in stock during the festive period as sales tend to be depressed. “The second quarter update will

show a clearer picture of the growth in the fruit category.”

Two of the three tea growing Estates will have new tea processing plants in the current year. This will improve production efficiencies, whilst reducing overhead costs and improving quality. The last new tea processing plant will be paid for and installed by July 2020. The macadamia drying facility installed in 2017 was doubled in capacity in the current period and will be available for use on the current year harvest.

“This will enable the group to further improve on its average selling prices for

macadamia as its production would be able to be processed in the plant, where the high specifications required by international buyers will be achieved.”

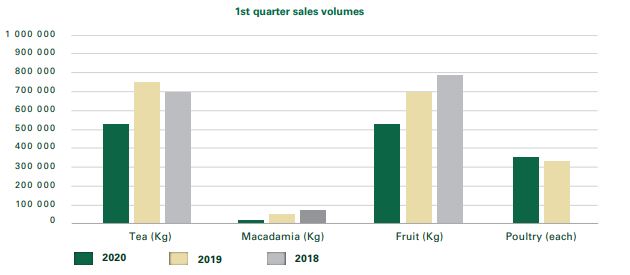

In terms of sales, f macadamia, fruit and poultry are in line with prior period. Export tea sales, however, were subdued in the first quarter. although the situation improved in January 2020 once the auctions reopened after the festive break.

Overall, the group’s production performance paints a generally encouraging picture. More so considering the impact the current economic environment has typically had on local production. As such financial performance for the year ending 30 September 2020 will be in line with that achieved for year ended 30 September 2019.

On the ZSE, The current uncertain economic environment, is expected to drive trading activity and although the focus will likely be on more liquid counters, the export linkage should translate to a market for the share. Assessing the group’s prospects, provided operations remain sustainable as the economic environment evolves, the outlook should be positive. Expectations will be for more fair value adjustments in the year-end financial statements, which should prop up profits if needs be.