Samuel Mapuranga

The outbreak of coronavirus named COVID-19 has disrupted the global economy. Evolution of the disease and its economic impact is highly uncertain, which makes it difficult for policymakers to formulate an appropriate macroeconomic policy response.

In essence, even a contained outbreak could significantly affect an economy in the short run. The more contained authorities want the novel coronavirus to be, the more they will need to lock down the country – and the more fiscal space that will be required to mitigate the deeper recession that will result. However, the problem for most Sub Saharan African countries is that policymakers lack fiscal space even in the best times, as a range of policy responses will be required both in the short term as well as in the coming years. Again, the kinds of stimulus measures deployed by developed countries could perversely make things worse for developing countries.

While in the short term, the Reserve Bank of Zimbabwe (RBZ) and Treasury have implemented policies to make sure that disrupted sectors of the economy continue to function while the disease outbreak continues. In the face of real and financial stress, there is a critical role for governments. The central bank reduced interest rate from 35 percent to 25 percent in an attempt to influence banks to reduce lending rates to distressed borrowers and prop up a limping economy. While cutting interest rates remains a major response for the central bank, the shock is not only a demand management problem but also a multi-faceted crisis that will require monetary, fiscal and health policy responses.

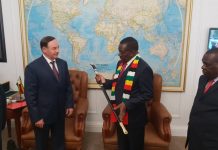

Policymakers at every level of government want to do everything they can to limit the spread of COVI D-19. In March, President Mnangagwa suspended all public gatherings including church services and sports events after declaring the coronavirus a national disaster. A raft of measures followed, culminating into a 21-day nationwide lockdown. It is the economic equivalent of pulling the emergency brake on a train: local, regional and natural economies are grinding to a halt. In a bid to reduce the macroeconomic impact of this economic halt, FinMin Mthuli Ncube announced “mitigatory measures” for the economy on coronavirus including duty suspension on imported material meant to fight the spread of coronavirus. Some of the measures include redirecting the two percent Intermediate Money Transfer Tax (IMTT) to fight the pandemic as well as a cut on 2020 budget allocation to redirect money to coronavirus fight.

The mitigatory measures issued by treasury will also see cash transfers of ZWL$200 million/month to 1 million households.

While the measures are commendable, the impact of COVID-19 on businesses is devastating. Thus, fiscal policy needs to step up in a big way as strict containment has high macroeconomic costs. Economic costs of containment mount very fast and it is not delayed output but, lost output. However, determining how much fiscal policy needed is ultimately a function of the curve of the disease. Consequently, fighting the infection rate is an absolute priority. Quarantining affected people and reducing large-scale social interaction is an effective response.

Wide dissemination of good hygiene practices can be a low cost and highly effective response that can reduce the extent of contagion and therefore reduce the social and economic cost. However, immediate effects of the shutdowns are obvious: as people opt to stay in, rather than go out, businesses of all kinds suffer. Revenues decline. Staff are laid off, many without pay for the foreseeable future. But the knock-on effects of the shutdown could persist for a long time, especially if the key personal and business networks that facilitate commerce are allowed to deteriorate.

In order to avoid a macro economic crisis, authorities need to step in to ensure that important networks in the economy are preserved. While containment of the pandemic is the utmost priority, health practitioners should work together closely with macroeconomist to avoid a deep recession. There are three main roles for fiscal policy in the COVID-19 crisis and these include infection fighting (spending as much as needed both to deal with the infection now and to give incentives to firms to produce tests, drugs and vaccines), disaster relief (providing funds to liquidity constrained households and firms), and support of aggregate demand (making sure that the economy operates as close to potential as it can).

Infection fighting and disaster relief measures.

Getting the infection rate down is an absolute priority. Zimbabwe has been in a major state of disaster for more than two decades with a struggling economy and a dilapidated health care system that has continued to impact negatively on the livelihoods of ordinary people. Policymakers need to protect the public health care system so that it won’t get overwhelmed. Apart from measures announced by FinMin Ncube, more needs to be done in order to keep the pandemic under control in the long-run. Apart from confinement/lockdown measures, more tests, more respirators, more masks and other vital medical supplies are essential. The bottom line, however, is that spending on containing the infection is essential, existential, and expensive but still small in macroeconomic and budgetary terms – less than 1 percent of Zimbabwe’s GDP.

Disaster relief is also a no-brainer and an urgent need in Zimbabwe. A large proportion of households has no cash reserves. Because of either low demand or forced lockdown, many small and medium – size enterprises, which represent 65 percent of total value in Zimbabwe, have insufficient cash reserves to survive more than a few months. It is of the essence to provide them with enough cash to survive the crisis. The main issue is how to quickly get the funds to the people and firms in need. Much work is now going into how to do it. These run from suspending or cancelling tax payments, to unemployment benefits, to asking firms to advance the funds to workers, to asking banks to advance the funds to firms in need with the state providing the final backstop.

Zimbabwe is in the grip of a nationwide drought that has caused harvests to fail and prompted the government to appeal for US$464 in aid to starve off famine. It is disastrous for a nation whose economy has been driven into brink of collapse by two decades of gross mismanagement, meaning authorities need to move with speed to avert a possible near catastrophic. Currently, authorities cannot extend water access to a burgeoning urban population. As horrific as this sounds, the consequences are plain to see not only in disease burden, but also in terms of the economic devastation the nation will face.

Supporting aggregate demand is a more delicate act.

Macroeconomist initially saw the pandemic as a negative demand shock that would need to be countered by expansionary fiscal and monetary policies to support aggregate spending. Consequently, a series of stimulus packages in the past few days – unprecedented in both scale and scope were announced by major developed countries and China to extenuate the mounting economic damage to the health crisis. Soon enough, many of them realized that this shock is different. In a normal recession, control of aggregate demand would be the main motivation for fiscal policy. This, however, is not normal recession, and it has important implications.

Zimbabwe however, face distinct pressure and constraints. The country relies for foreign income on a combination of commodity exports, tourism and remittances: all are expected to collapse leaving the economy short of dollars and government short of tax revenue. In March, a number of players in the tourism sector closed including Africa Albida Tourism and African Sun Limited. The COVID-19 pandemic is first and foremost a supply shock. That changes everything. In the short run, so long as confinement and lockdown constraints are on, potential output will remain much lower. Sustaining demand above, above potential, say, through tax cuts for firms or households, may lead to rationing and inflation rather than increase in activity. If companies are not producing because their workers are locked down, boosting demand will not magically make goods appear. Major focus should be on how to make physical distancing and lock downs tolerable and limit the damage that the supply shock will generate.

Infection fighting and disaster relief are the highest priorities. Unless the fight against the virus turns out to be much tougher and longer than expected, they imply large but not gigantic deficits. الدوري السعودي النسائي Doing more to increase aggregate demand may be unwise in the short run, and a boost may or may not be needed later. Flexibility here is of the essence. Zimbabwe currently faces distinct constraint which make it significantly harder for policy makers to enact effectively stimulus without facing binding foreign exchange constraint. The Southern African nation already experiencing its worst economic crisis in a decade saw industry capacity utilization slumping to 36.49 percent in 2019. Mainly due to power deficit, acute foreign currency shortages and policy inconsistency. Like many developing nations that were slowing down in the final quarter of last year with several entering recessions, Zimbabwe experienced a negative GDP growth of 7.1 percent in 2019 and is projected to remain in recession in 2020 unless the situation improves by mid-year.

Talk about Catch – 22, the COVID-19 pandemic is an inescapable reality right now for Zimbabwe. In face of high uncertainties, it is sensible for policymakers to stick with the bottom–line mindset, adjust perceptions of the situation and reposition policy plans. Whereas the current plan adopted by FinMin is based on assumptions of a relatively stable external economic environment or a mild contraction, which may not be enough to deal with possible super external shocks. In light of these perceptions, Zimbabwe needs to take action in advance to weather the potential super-blow dealt by pandemic and the global economic and financial fallout which may manifest from May–August period. First, Zimbabwe needs to expand domestic demand by repositioning fiscal and monetary policies. Second, the authorities should keep a close eye on the condition of export – oriented industries amid the global supply chain disruption, helping them to avoid suffering from serious external blows. 31 طاولة

The economic fallout from COVID-19 shock is ongoing and increasingly difficult to predict but there are clear indications that things will get much worse for Zimbabwe before they better. Portfolio inflows have dropped significantly. انواع البوكر Commodity prices have also dropped precipitously since the crisis began. While maintaining a mild approach, some of the broad measures to implement include a reduction in business taxes, small business loans and grants, loans and guarantees to large business and government, grants and support to transportation providers/industries, aid to local government, health care spending and safety net support in form of food and housing support as well as education spending.

Samuel Mapuranga writes in his own personal capacity. The views expressed in this article are those of the author and do not necessarily represent any organisation. Feedback: Email – [email protected]; or Twitter: @Sa_miiM