The Second World War and its global monetary aftermath: The gradual shift from imperial – colonial links towards US-led liberalism, the 1940 – 1950

Tinashe Nyamunda

The Second World War was an important turning point in the shift of the international balance of power. While Britain was the most powerful imperial power from the mid nineteenth to the mid twentieth century, the impact of two world wars (the First [1914-1918] and the Second World War [1939-1945]) and a depression had taken its toll. This same period witnessed the rise to super power status of the United States of America, and much of this was expressed in monetary terms as this week’s article will explore. The post 1945 changes in imperial – colonial relations demonstrate the centrality of money to global power dynamics.

The previous articles examined how Britain had used a range of strategies, not least of which included violence, to impose its rule on African colonies. Money became an important tool of colonial economic control in which London was the chief beneficiary while the settler populations benefited from their economic connection with the centre. The settlers profited in sterling from commodities extracted from Southern Rhodesia on the basis of exploited ultra-cheap African labour from the colony. The structure of the colony was such that the settler government and community had arrogated to themselves the lion’s share of the land and other resources of the colony while Africans were reduced into a huge labour reserve to be exploited for the benefit of the colonial economy.

What made Southern Rhodesia unique from other African colonies was its self-governing status based on a local settler government. Whereas other colonies were governed through the colonies office, Southern Rhodesia had its own governmental system based on the 1923 constitution in which its parliament had significant room to manoeuvre except where Royal assent was required in terms of railways, African (“Native”) policy and currency. Those countries directly governed through the colonial office received, in the mid 1920s, colonial welfare and development funds but, because of its colonial status, Southern Rhodesia never received these funds. So by the 1940s, the colony’s development was based on settler economic manoeuvres and it never benefited from the proceeds made available from the Colonial Welfare Development Act (1940) which other colonies received. This increased settler entitlement even in the face of African demands for decolonisation.

By the 1940s, sterling monetary imperialism had become rooted despite the existence of a colonial currency and Currency Board. It was on this basis that developments in the early 1940s took place. The Second World War, as Economic Historians such as Alois Mlambo, Ian Phimister and Victor Gwande have shown, created bottlenecks in the supply of industrialised goods that were imported from Britain. This provided the local settler economy with an opportunity to industrialise, allowing the growth of the manufacturing industry during the course of the 1940s. War-time economic disruptions in Europe also created a vent for surplus for local commodity markets as well.

With economic expansion came increased urbanisation. As the black proletariat also increased, workers began to organise themselves. Under the Industrial Conciliation Act (1934), black people had been excluded from the definition of workers so as to continue exploiting them. As a result, they were not allowed to form trade unions or get involved in such job actions as strikes, go slows etc. But white workers were covered by this legislation and could negotiate better conditions and remuneration. However, as the skilled labour force (mostly white) came to be in short supply because many were recruited to join the war, the demands on African labour increased. Black workers took the opportunity to begin organising themselves against white monopoly capital through leaders such as Charles Mzingeli of the Southern Rhodesia Industrial and Commercial Workers Union and Benjamin Burombo of British African National Voice Association, for example. The various labour unions that emerged helped organise workers fight against exploitation and workers began demanding improved income, working and living conditions through, for example, the 1945 railways strike and the 1948 general strike. African political participation increased as evidenced, for example, by the activities of the Samkange family or such individuals as Joshua Nkomo amongst others. Africans’ resistance to colonial economic exploitation and the political organisation against it increased in the course of the 1940s and accelerated in the 1950s.

But for all the progress that the settler state made in the colonial economy and the political advances of Africans for colonial reform and ultimately African nationalism, a number of global events were shaping the establishment of a new world order. This would recalibrate imperial – colonial relations and shift relations of extraction and control in new ways.

Prior to the attack on Pearl Habour on 7 December 1941, the USA had been neutral. This attack by Japan provoked the United States to enter the war. The time USA had been neutral had allowed it to make serious economic gains while the European countries involved in the war were devastating each other in terms of human and capital losses. Even after the end of the war, where Britain had emerged victorious but broke, the United States had consolidated its economy and even provided loans to European countries. On the eve of the end of this war, the Washington had invited 44 allied nations, including, Britain to discuss the future of the global economy at Bretton Woods, New Hampshire in the USA in 1944. The event, attended by 730 delegates came to be known as the Bretton conference. It was the outcome of this meeting that would shift the course of global economic affairs.

The USA offered to help the devastated European economies through a number of initiatives. These were as follows. First, it was resolved that the gold standard, which Britain had abandoned in 1931 during the depression needed to be revived, but only by a country with the economic capacity to do so. Because of the huge debt incurred for Britain’s war effort, London could not sustain this, therefore, the responsibility shifted to New York. The USA’s currency became anchored on gold, as had sterling, at the rate of US$44 an ounce. All other currencies would become convertible into the US dollar. As a result, the US currency became the new global key currency, taking over this role from British sterling. This would have lasting implications for Britain and its control of currencies in the colonies. This became known as the Bretton Woods system or the reformed gold standard, and it lasted until 1971 when the American President, Richard Nixon took the United States dollar off gold.

Under the Bretton Woods system, two institutions were formed. The Bank of Reconstruction and Development ([IBRD]later a part of what became the World Bank), and the International Monetary Fund [IMF] were established in 1944. These two multilateral institutions were created to provide loans for European countries devastated by the Second World War to facilitate their economic recovery. Over time, they became styled as development institutions that would provide finance to facilitate infrastructural and other developments internationally or provide balance of payment support to indebted countries. In pursuing this purpose, these multi-lateral institutions have rolled out the neo-liberal structural adjustment programmes that have devastated African economies in ways examined below. New American liberalism introduced at Bretton Woods would become the basis of American global political and economic hegemony. For many of the countries to benefit from World Bank and IMF loans, as would happen with Zimbabwe between 1990 and 1995, countries had to follow economic prescriptions (based on problematic free-market principles) of these financial institutions and meet the tenets of American style democracy. But, the market would never have been as free given the anchoring of peripheral economies on the US dollar and American style demoncracy gave the USA the capacity to influence in the politics of these nations. The USA led the financing of post war recovery in Europe, providing up to US$12 billion to European countries for post-war recovery through the 1948 Marshal Plan.

But what did all these changes mean for British imperial power in Africa, especially where currency was involved. Britain realised that this meant a shift in the global balance of power, but a sudden shift would have been problematic. As such, this retreat of Britain from this position, as well as sterling as a global key currency had to be gradual. If it was too sudden, it would have had strategic problems, not just of London, but Washington as well in the context of an escalating cold war, an ideological conflict between capitalism and communism.

On the one side was the Union of Soviet Socialist Republic (USSR) which had taken on the course of communism following the ousting of Tsar Nicholas and the rise to power of Vladimir Lenin after the Bolsheviks revolution of 1917. On the other was the USA and Western Europe that sought to retain the capitalist mode of production. Capitalism was based on free market principle anchored on private property informed by the teachings of such scholars as Adam Smith whereas under communism, the mode of production would be communally owned under the custodianship of the state. The colonial state, particularly in Southern Rhodesia and South Africa, had established a settler based type of colonial capitalism. The USA still needed a more stable ally in the United Kingdom in order to keep check on the rising influence of the USSR.

To maintain this balance, negotiations were held with representative countries but the most important of which were the USA and Britain because of their powerful global status. On the economic and monetary front, the USA was represented by Harry Dexter White and Britain by Lord Maynard Keynes of the Keynesian theory fame. While Keynes had favoured a clearing house (which would act as the world’s main central bank in ways different to how the World Bank currently operates) to regulate international exchange, White manage to flex American muscle by pushing through the Bretton Woods system and the creation of the multi-lateral financial institutions, the IMF and World Bank. But the new order would operate on the basis of liberalised global markets, in other words, where the imperial centres no longer had a monopoly over colonial economies.

Prior to 1945, the world had been divided into imperial and colonial areas. In British Africa, London benefited from access to its colonial markets ahead of its competitors just as other imperial powers. This meant that the USA had had limited access, but liberalism allowed them to gain a newer and increased foothold. It advocated for “free” markets as opposed to colonial markets. But the negotiations with Britain in the context of the cold war in which a gradual retreat from international dominance was negotiated, the liberal approach was gradual in the first decade. London was allowed to try and use its colonies to help aid its economic recovery.

Britain needed its African colonies to stimulate its economy far more in the post-Second World War period than ever before as it had lost India as a colony and its dominions began liquidating their sterling holdings at the Bank of England preferring to anchor them on the dollar. For this reason, Britain retained its colonies in the sterling area. In terms of crisis, this is not the only time Britain has done this. Fast forward to Brexit, Britain is again looking to forge trade links and partnerships with its former colonies, including Zimbabwe, in a bid to try and stimulate its economy again. As Economic Historian Gerold Krozewski has shown, London even put in place, with Washington’s agreement, an Empire-wide restrictive Exchange Control Act (1948). This allowed Britain to establish a discriminatory sterling area. What this meant was that British colonies had to trade within the sterling network as far as possible.

This led to what some Historians have termed the second colonial occupation. From 1948 until 1957 when British Prime Minister Harold Macmillan took over from Anthony Eden, Britain had tried to revitalise Empire as well as retain its economic links with its independent former colonies and dominions through the commonwealth. Especially under Winston Churchill, the crown had tried to use the commonwealth to re-establish its former glory as the next article will unpack.

So in the 1940s, when Rhodesia was trying to move towards dominion status and establish a larger form of autonomy from Empire, Britain was unprepared for this. This was especially the case in matters of currency. In the late 1940s, the old question of currency autonomy and a central bank was brought up again. Godfrey Huggins government was still eager to deliver the promise of currency autonomy and a central bank which would have allowed the colony to determine its own economic course. But in the context of a discriminatory sterling network and second colonial occupation, Britain was unwilling to allow such autonomy. But given Southern Rhodesia’s contribution to the war effort by sending troops, hosting an imperial air training scheme, for example, for which London was grateful, the challenge was how to refuse assent without provoking disaffection amongst the settler government in Salisbury.

In the end, the British hid behind setting up a commission of inquiry into the establishment of a central bank headed by a British official Lord Mynors. Documents at the Bank of England archive show that regardless his findings, Mynors was never supposed to recommend the establishment of such an institution. The economic situation in colonial Zimbabwe in 1949 when the Mynors report was tabled was such that, although boasting a diversified economy with a growing manufacturing industry established on the basis of war-time Import-Substitution-Industrialisation (ISI), the colony had only two commercial banks, Standard Bank and Barclays and the stock exchange had only just been established in 1946. Mynors, thus concluded that creating a central bank for the colony was too premature would have been “tantamount to using a sledgehammer to crack a nut”. In the end, the colony would have to utilise the Currency Board until 1956.

Britain thus succeeded in retaining economic control over Southern, at least until the mid-1950s. But the post-Second World War dynamics had stimulated inevitable changes. Although London was allowed through the Bretton Woods agreement to stimulate recovery through restrictive exchange control in its Empire, the changes ushered in by the Second World War would change global economic dynamics significantly.

While Britain used Southern Rhodesian Virginia tobacco exports to London to substitute the American south Virginia markets to save dollars and exported Northern Rhodesian copper to raise dollars pooled at the Bank of England, the wave of liberalism was unavoidable in the long run. Restrictive monopoly to colonial markets was on the brink of being changed under the guise of freeing markets from these kinds of shackles and making the US dollar a global key currency was part of this strategy. The process of ensuring this global liberalisation of trade was cemented in the 1950s as the following article will show. But by the end of the 1940s, settler ambitions for economic devolution and the pursuit of dominion status were frustrated.

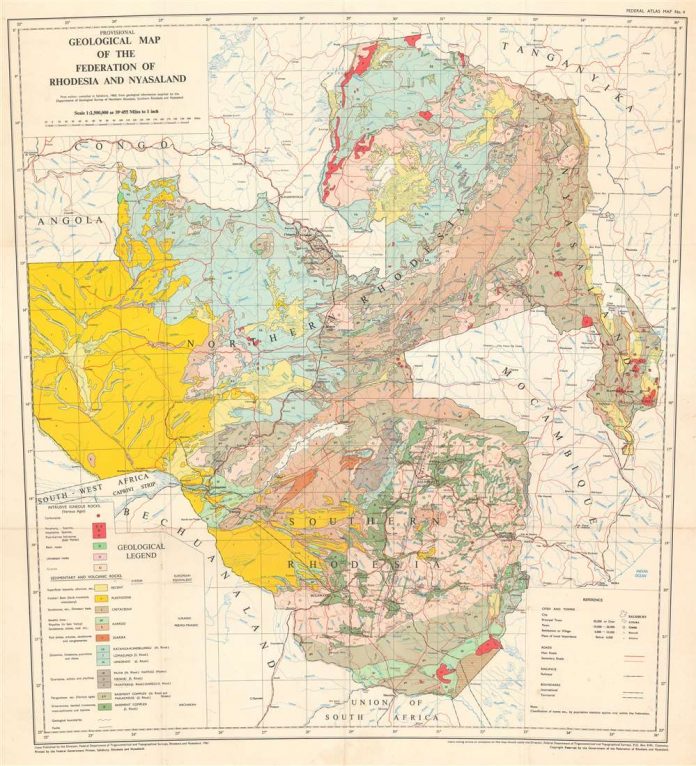

The alternative was to form an expanded market. Huggins and Northern Rhodesia’s Roy Wellensky began the process of negotiating with London about an amalgamation of the two colonies, Southern and Northern Rhodesian. They wanted the joining of the two Rhodesias as a way of expanding the economic size of the colony as well as increasing the white population in the interests of eventually attaining dominion status. This would influence the developments that would result in the formation of the Federation of Rhodesia and Nyasaland.

But even with these developments, American liberalism and the retreat of London from its previous global prominence would encourage demands for political and economic devolution amongst its colonies. However, what the world was unprepared for was how the new liberalism, or neo liberalism would shape and reconfigure international economic relations. By the end of the 1950s, the global monetary system had started changing and the Bretton Woods system were reshaping relations of production and exchange in ways that were beginning to transform the colonial into a neo-colonial world.

Look out for the next article to see how the developments in the 1950s shaped the direction of international relations of exchange and how these informed the trajectory of colonial Zimbabwe’s monetary system.

- Tinashe Nyamunda is in the African Modernities Past and Present Research Group at North West University (South Africa) where he is Associate Professor of Economic History

Very insightful article

Well articulated. Keep on writing good and eye-opening pieces Dr. Nyamunda.